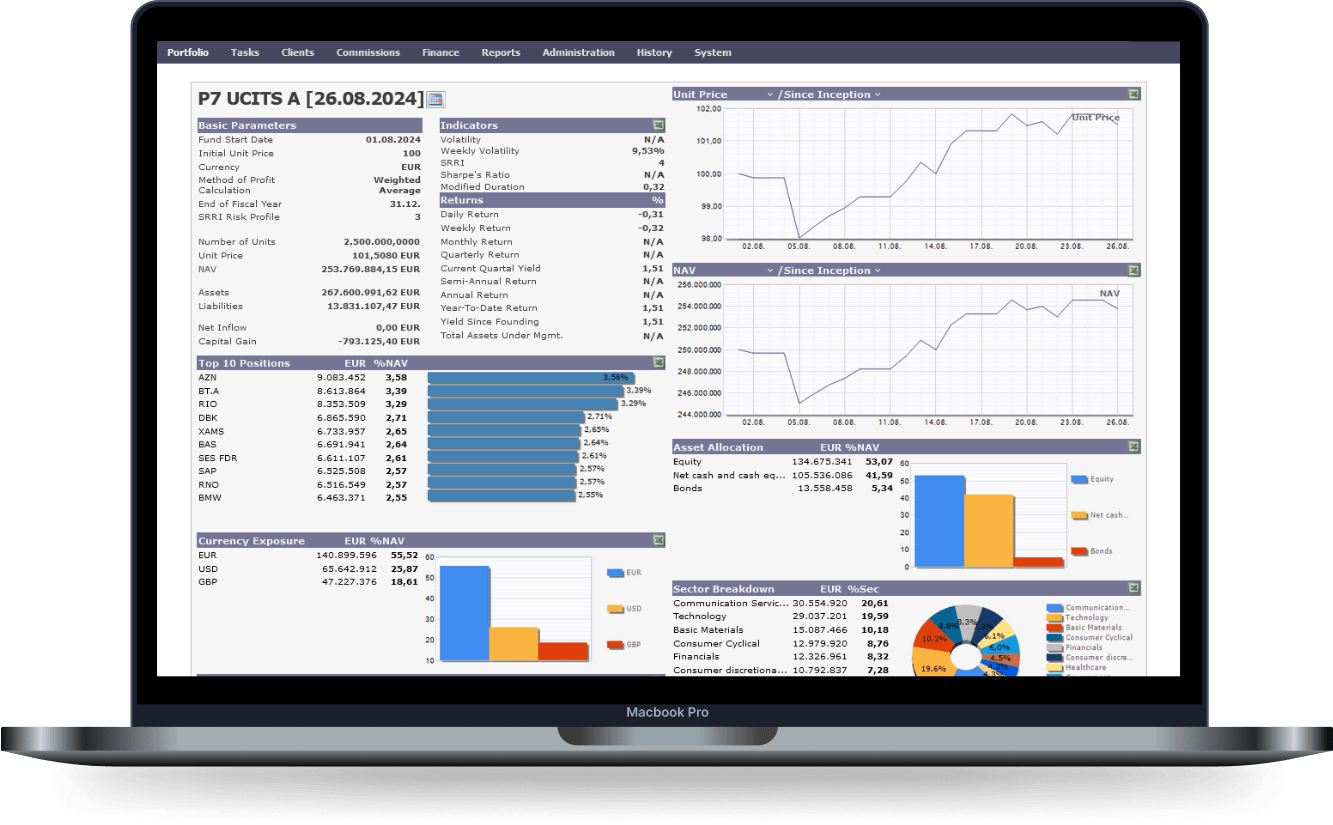

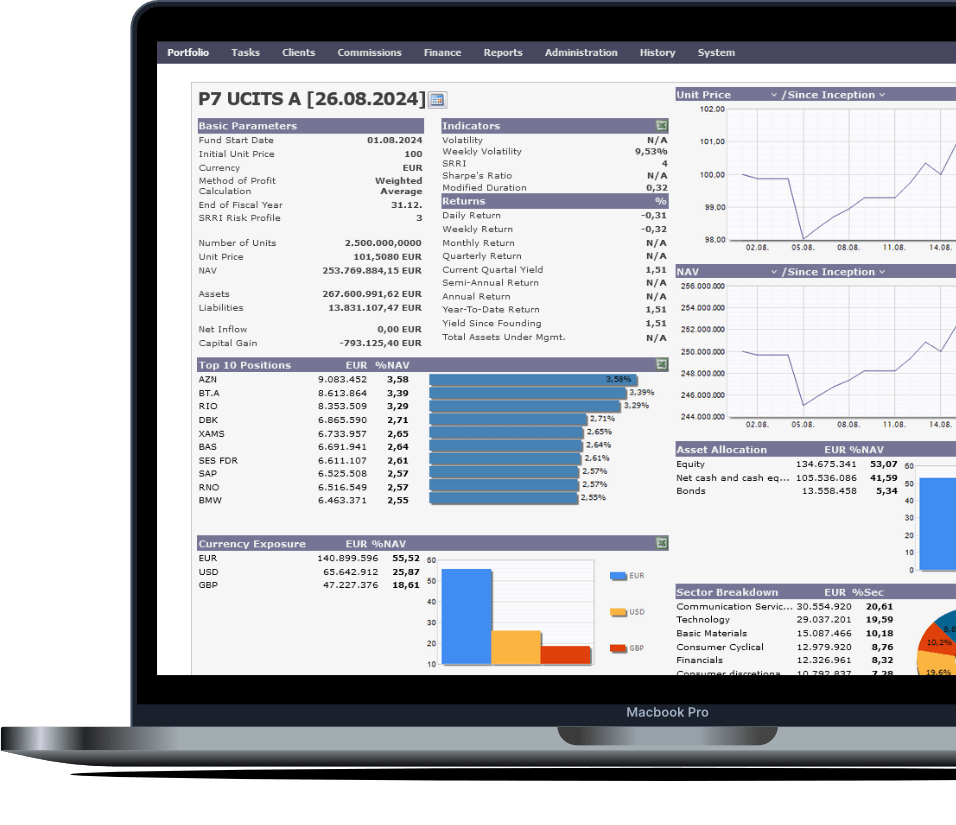

All-in-One Financial Software for Funds & Treasuries

Transforming fund management and treasury operations.

Discover the power of one comprehensive platform.

Your Complete Solution

for Funds and Treasuries

In a rapidly evolving world of finance, filled with stricter regulatory and more stringent reporting requirements, financial institutions need an accurate, robust, and reliable solution.

Designed specifically for the fund industry and treasury operations, our intuitive, scalable and modular platform supports different parts of your business, helping you to:

- simplify workflows

- improve efficiency

- enhance performance

- reduce operational risk

- achieve compliance.

Your Collaborative Partner in Digital Transformation

With nearly two decades of experience serving the fund industry and insurance treasuries, we bring a wealth of expertise and deep domain knowledge to every project. Our strength lies in the synergy between seasoned software developers and financial industry professionals. Together, we deliver reliable, high-quality software solutions that transform your operations, helping you navigate complex, highly regulated financial environments with confidence.

Our clients

Trusted by a diverse range of fund management companies, depositary banks engaged in fund administration, insurance companies, and pension insurance firms in Europe, including:

We deeply value these partnerships and remain committed to delivering innovative and dependable software solutions.